From the Founder: Timely Interest Rate Announcement

John, Matthew and I recently attended an investment conference together. There were many presentations and discussions related to the stock market, the economy, and, of course, the upcoming elections.

.

In addition to those topics, the biggest takeaway we all had was regarding interest rates. As I’m writing this, inflation has recently been cooling off, and Fed Chairman Jerome Powell has suggested that they will begin dropping interest rates later this year.

.

While none of this is likely surprising news to you, we felt one of the speakers made an interesting point. He compared the current situation to mortgage rates back in 2021. You see, if you had a mortgage at that time and locked in your rates, you could have locked in a 30-year mortgage at an incredibly low rate – even as low as 2.65%. (I don’t know about you, but I couldn’t help but think of my first mortgage rate, which was 7% – what a difference!)

.

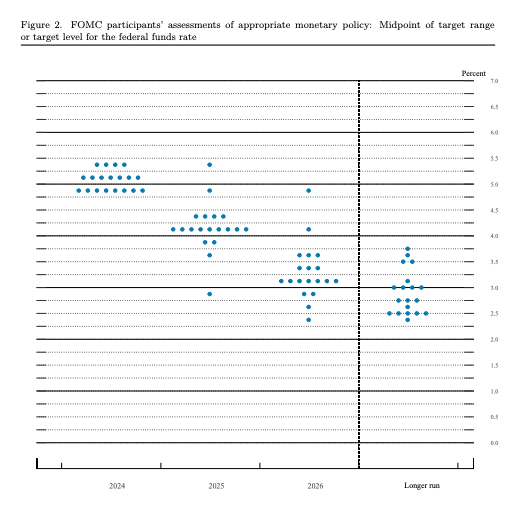

Locking in a mortgage rate in 2021 could provide you with huge savings on the interest you owe. The comparison made at our conference was that the same could be true of locking in rates on your savings and investments over the next few months. While no one knows what interest rates will be in the future, the Fed periodically provides its best estimate. As seen below, the Fed expects rates to drop by 2% over the next two years.

.

This means that if you’re enjoying 4% interest on a money market account, that rate may be cut in half over the next two years.

.

Our advisor team believes this is an ideal time for us to review your accounts and see if it could be beneficial to you to lock in rates of any kind. This could apply to many different situations. While this list isn’t complete, I thought I would list some examples for your consideration:

.

1. If you currently have money in savings or money market, now is an ideal time to consider how much you need to have immediate access to. For example, if you believe that you need $50,000 that you can access immediately and you have accumulated $100,000 in savings, we should consider locking in a current rate for your additional funds. This could be as simple as a CD or perhaps locking in a fixed-rate annuity for the next three or five years.

.

2. If you have benefited from the stock market increases over the last four years, perhaps it is time to consider locking in a portion of the gains and transitioning those funds to something with fixed rates. No one knows the stock market’s future, but I’ve mentioned in a recent commentary how Schwab’s recent market analysis showed the markets currently being overvalued. This doesn’t guarantee a market drop, but it is certainly an important consideration.

.

3. If you have an annuity that was issued when interest rates were lower, we believe this is a very important time to do a review of your annuity. Our current analysis shows that some growth rates and even income payouts could be substantially higher now. While we usually seek to help you avoid fees in all cases, this is an unusual rate environment, and it could be our best opportunity to lock in the best terms possible. Therefore, we think this may be an extremely unusual situation in which it could actually be beneficial for you to pay a penalty now to improve the terms of your contract.

.

Allow me to explain in a little more detail: if you allocate to a long-term annuity, such as 10 to 12 years, the annuity company is investing your funds for that entire term up front. This means that interest rate increases during your term do not necessarily mean that your annuity gains will increase. On the other hand, if current rates are the highest we will see in a long time, we believe it could be an ideal opportunity to lock in long-term annuity rates. As an example, some annuity companies now offer both seven and ten-year options. In my most recent update meetings with clients, we have opted for the ten-year option, as we believe we want to lock in current terms as long as possible.

.

Our advisor team is already working to review your accounts with us, and if we believe there may be an opportunity, our office will reach out to you as quickly as we can. We want to make sure to take advantage of this window if rates change sooner than later. Because of this, we may suggest an initial phone call instead of a full in-person update meeting. If you have an annuity that we planned to pay income in the future, your advisor will likely ask you to estimate when we might want that income to start. You won’t be held to that timeframe, but it will allow us to have an apples-to-apples comparison for our call.

If you have funds that aren’t managed by Preservation Specialists and would like to discuss them with us or learn about potential solutions, please don’t hesitate to reach out to us. While it may not be the same as locking in a 30-year mortgage, we hope that we can assist you in generating better returns for the future by making smart decisions today.

SOURCES

1 Foster, Sarah. “The Federal Reserve’s Latest Dot Plot, Explained – and What It Says about Interest Rates.” Bankrate, 12 June 2024, www.bankrate.com/banking/federal-reserve/how-to-read-fed-dot-plot-explained/#key-benefits-of-reading-the-fed-s-dot-plot..

Learn more about your current financial status and how you can achieve your retirement goals with our ‘No Obligation, No Cost’ Five Step Retirement Review.

Our financial planners have wide knowledge in South Carolina Retirement System as well as experience in retirement planning. sc tax rebate, etc. Contact us today!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.