From the Founder: Where Do The Markets Go From Here?

On May 17th, the Dow Jones hit 40,000 for the first time. I don’t know about you, but whenever the Dow hits a milestone like this, it makes me feel kinda old; and that is because it seems like I’ve lived through so many of these different milestones.

.

You see, when I started working as an advisor on January 3rd of 1997, the Dow Jones was 6,544. That means I’ve been around for a lot of Dow celebrations, starting with 10,000 and continuing until today.

.

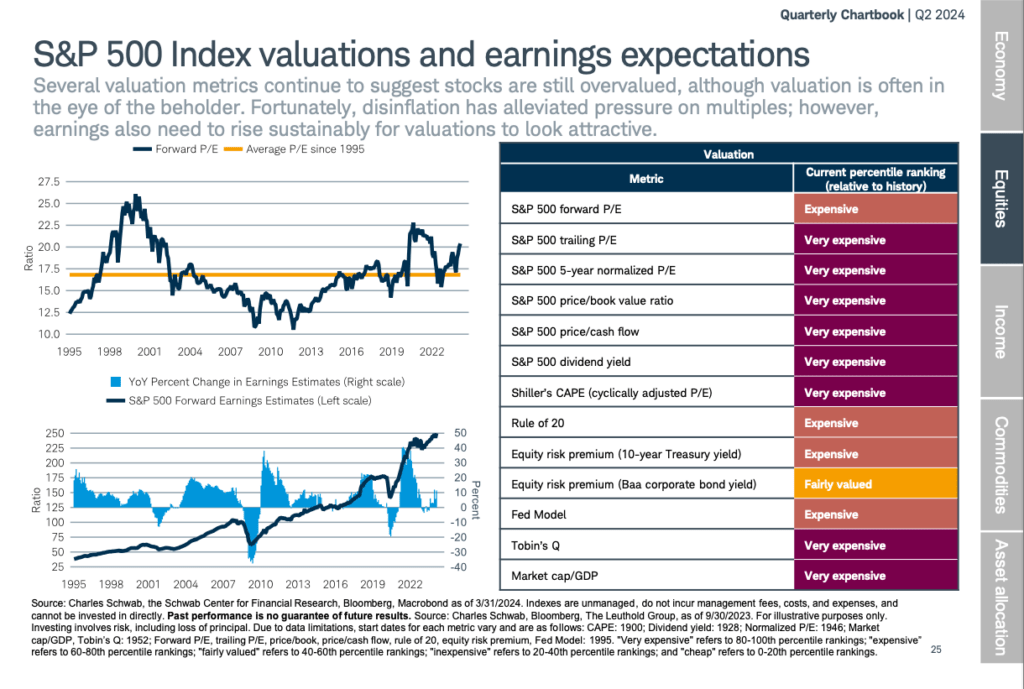

I was thinking about these sorts of milestones as I was reviewing Schwab’s recent Quarterly Chartbook which provides data on all sorts of market and economic information. The following chart is the one that jumped out to me the most:

.

The left side of this summary gives a couple of detailed charts. To me, the right side is the most telling. Schwab believes there are 13 different ways to evaluate if the stock market is valued properly. Of those 13, 12 of them say that market is ‘expensive’ right now, and eight of them say the market is ‘very expensive.’ If the stock market is expensive, that means the values are too high.

.

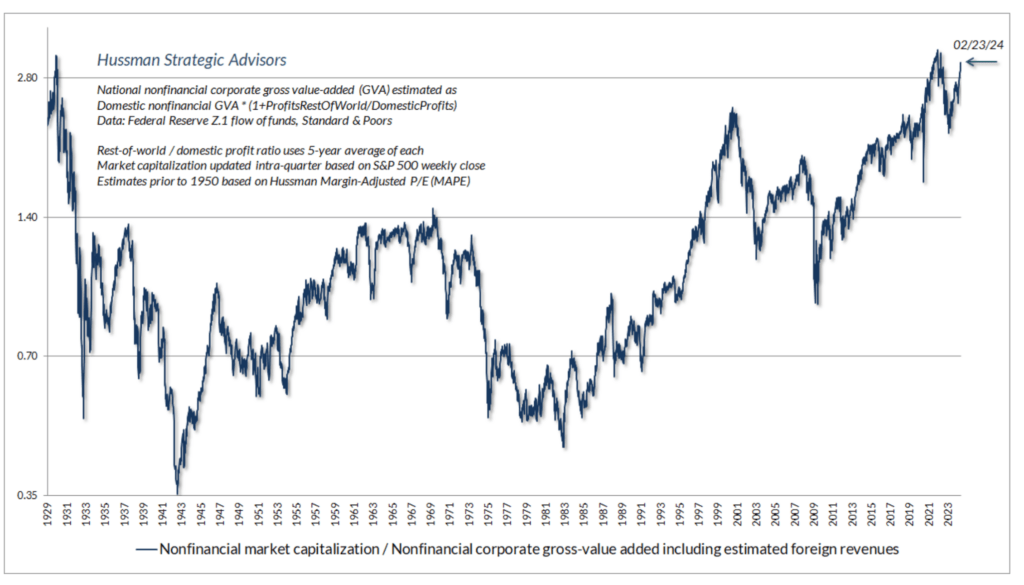

Now, if you’re like me, that raises your heart rate a little! I do like to research this type of information regularly, and it reminded me of a chart I saw recently by Hussman Strategic Advisors:

.

While I don’t pretend to understand all of the in’s and out’s of their formulas, Hussman is a highly regarded advisory firm, and their chart suggests that the markets are higher than at any time since right before the great depression in the late 1920’s.

.

In fact, their current estimate of the expected 12-year return of a portfolio invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills is currently negative. Yes, they believe things are so overvalued that we could see returns of 0% or worse for a number of years into the future.

.

In their technical terminology, they say this: “We can’t know the future, but it’s straightforward to examine history and do math. Presently, market conditions have a stronger positive correlation with historical market peaks, and a stronger negative correlation with historical market lows, than 99.9% of instances across history.”

.

In plain English, they think the current environment looks like the top of the U.S. stock market.

.

Of course, we know that no one can predict the stock market. We also know that the stock market can be overvalued, and it can stay that way for quite some time. So, please understand that I’m not making any predictions here. Rather, I would note a few things:

- First, if you are near or in retirement and have a substantial amount of your nest egg tied to the U.S. stock market, it might be a great time to review your allocation and consider if it should be adjusted.

- Second, if you are working with us and have already allocated your nest egg in relation to the three levels of the financial house, then if the market falls, you should already be prepared. As I mentioned last month, none of your other investments will match the U.S. stock market when the market is flying high. But whenever the market starts to fall, your diversification will begin to pay off.

- Third, I can’t help but add my favorite reminder: whether you beat the stock market or not doesn’t matter one bit. What matters is that you accomplish your financial goals, and the best way to do that is to build a retirement plan and to stick to that plan.

.

As always, we are here build, implement, and manage your retirement plan. Also, we realize that role requires a great deal of trust on your part, and we never take that for granted. Thank you for your faith and trust, and we look forward to assisting you for many years to come regardless of what the markets do next.

Learn more about your current financial status and how you can achieve your retirement goals with our ‘No Obligation, No Cost’ Five Step Retirement Review.

Our financial planners have wide knowledge in South Carolina Retirement System as well as experience in retirement planning. sc tax rebate, etc. Contact us today!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.