From the Founder – Rising Interest Rates and Real Estate Investments

This month, I would like to focus on two things that are on a lot of people’s minds: increasing interest rates and your investments.

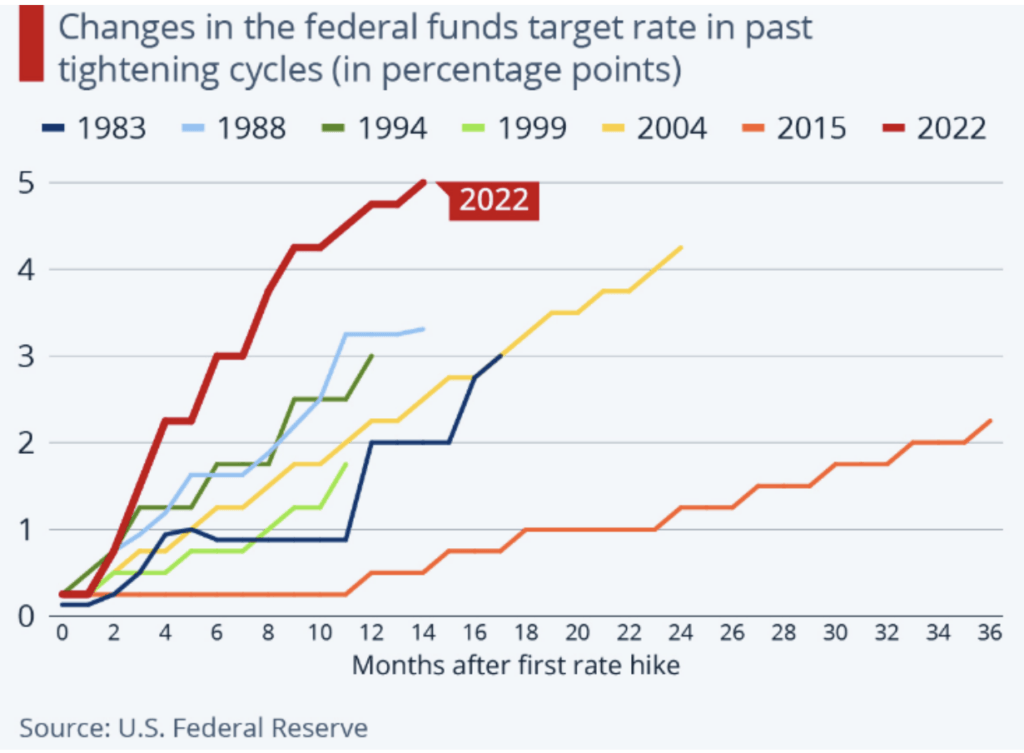

If you’re tired of hearing about interest rates, believe me, I get it! The reason I believe rates are being talked about so much is that the U.S. Federal Reserve has made not one, but two historic decisions in recent years. For the first decision, take a look at the chart below:

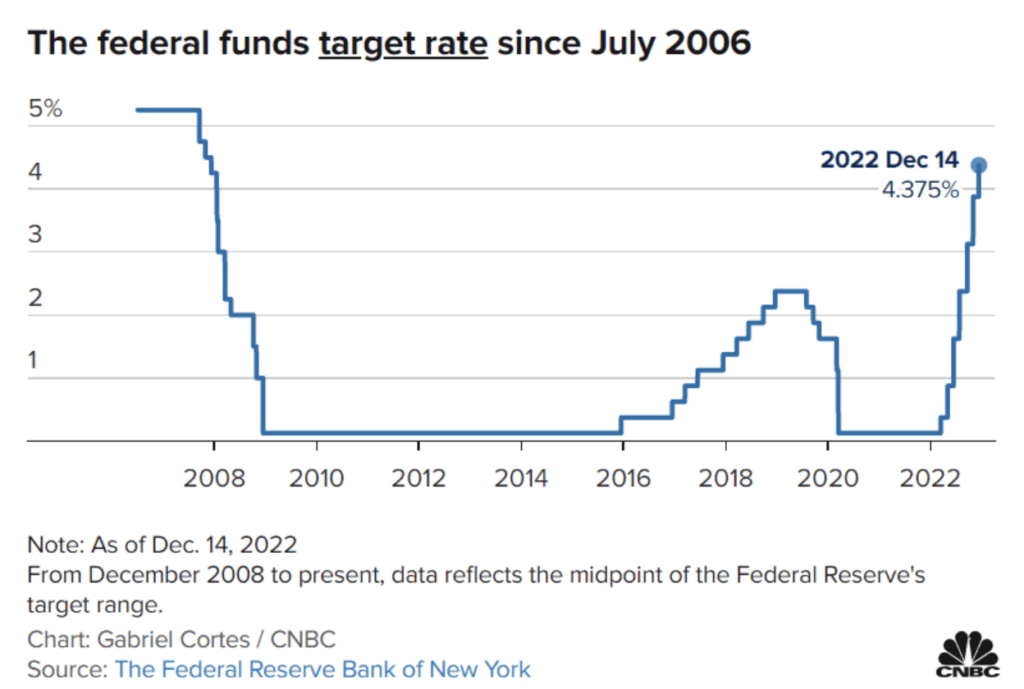

Since early 2022, the U.S. Federal Reserve has raised interest rates higher and faster than at any other time in it’s history! That alone would have a massive effect on our country and our economy; but this is actually the second historic decision they have made. Take a look at one more chart as we widen the view to look further back:

In addition to raising rates higher and faster than ever before, the Fed is doing so after keeping interest rates at historically low levels for…wait for it…longer than ever before!

These two decisions about interest rates have significant impact on your investments. So much so that I thought it would warrant discussing this over multiple months of articles. For this month, my focus will be on how these changes affect investments in commercial real estate.

Low interest rates are beneficial for investments in real estate for two reasons. First, if the portfolio manager is borrowing, they can do so at a low cost. The second reason is because the income generated by the real estate is so attractive compared to other options.

We’ve really like investments in real estate since the Fed dropped interest rates back in 2009. Think of it this way: if a real estate portfolio can pay dividends of 5 or 6%, that is a heck of a lot better than putting your money into a CD or a bond paying 1 to 1.5% interest!

Fast forward to 2022 and 2023: interest rates have soared much higher and faster than anyone previously expected. What we have seen from many of our real estate managers is that they have decreased the value of their portfolios. The manager’s portfolio may still be generating 5 or 6% in dividends, but now a CD might earn about the same interest. This means that the portfolio isn’t as valuable by comparison.

So if you have real estate investments in your portfolio, there is a good chance the value may have dropped during 2023. The good news is that we stay in close contact with our portfolio managers. In all of the discussions we’ve had this year, the real estate itself is in great shape. It is rented out and generating income. Don’t worry, it’s not some abandoned shopping mall that is surrounded by miles of empty parking spaces. (I mention this because I’ve had multiple clients ask!)

The next logical question is: what should we do about these real estate investments? While no one knows the future, we are confident that interest rates are at or close to the highest that they will be for a long time; and we also believe that interest rates will need to start going back down again reasonably soon.

Why do we have this confidence? First, lower rates benefit the economy. So the Fed will likely lower rates as soon as it feels it can. Second, our country simply can’t afford it. Our total debt has now crossed over $33 trillion. If interest rates stayed this high, the interest on our debt would eat up a bigger and bigger portion of our annual expenses.

To summarize, we believe that the real estate portfolios we work with are of high quality, and we believe interest rates will start to go back down again in the near future; and when interest rates go back down, then it is reasonable to expect the value of that real estate to go back up again. While there is no guarantee, it certainly feels like a great time to be investing in commercial real estate.

While some of that can be complicated, I hope it was helpful.

As always, if you have questions about any of this, reach out to your advisor. They are available to answer your questions about this and anything else related to you meeting your retirement goals.

Learn more about your current financial status and how you can achieve your retirement goals with our ‘No Obligation, No Cost’ Five Step Retirement Review.

Our financial planners have wide knowledge in South Carolina Retirement System as well as experience in retirement planning. sc tax rebate, etc. Contact us today!

Securities offered through Arkadios Capital, Member FINRA/SIPC. Advisory services offered through Arkadios Wealth. Preservation Specialists and Arkadios are not affiliated through any ownership

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.