Money and Memory

While no one can predict who might experience dementia in their later years, it’s prudent to include the possibility as you’re building your long-term financial plan. We’ve all had them: Moments when we’ve walked into a room and forgotten what we came in for. Or saw someone out and about and couldn’t remember their name.…

Read More →From The Founder: Taxes in America

Since April is often considered ‘tax month,’ I thought I would share a few tax charts that I found interesting. One of the opinions I’ve heard a lot in recent years is that our tax system is not progressive enough and that wealthy Americans are not paying their ‘fair share.’ Let’s see what the following…

Read More →Spring Clean Your Finances

Spring is a good time to organize your finances, clean up debt and credit issues, consolidate old accounts and develop good habits to work toward your goals. Do you have a space in your house in constant need of organizing? You know the one: the space where clutter seems to accumulate and visitors are never, ever allowed…

Read More →Spring Forward or Fall Back: Debating Daylight Saving

Are you tired of adjusting your clocks twice a year? Daylight saving time has been a subject of debate for decades, and while nothing has been decided yet, several recent state and federal laws have set their sights on the time-changing tradition.1 One argument against daylight saving time is that it disrupts our sleep patterns.…

Read More →From The Founder: Election Promises and Our Growing Debt

This month, I thought I would begin to share my thoughts on the upcoming election. No, I am going to predict who is going to win. I also won’t attempt to guess how bad the mud-slinging will get as the year progresses. Instead, I will keep my ideas focused on you and your finances. Recently,…

Read More →Navigating Peak 65: The Unprecedented Challenges Facing Retirement in 2024

In the vast landscape of American demographics, 2024 marks a pivotal moment – the arrival of Peak 65. With record numbers of baby boomers reaching this milestone, the retirement system is poised for unprecedented challenges. Approximately 11,000 Americans are expected to turn 65 every day until December, culminating in a staggering 4.1 million individuals joining…

Read More →Help Avoid Outliving Your Savings While Maintaining Your Desired Retirement Lifestyle

When it comes to retirement planning, all of us want to know we have enough money saved and how to make it last. We also want to feel confident that we can live our desired lifestyle in retirement. When it comes to planning for the future, it’s easy to fall into the trap of thinking…

Read More →Save Your Retirement “Edition 4”

I am thrilled to announce the official launch of the updated edition of “Save Your Retirement”! Whether you’re a dedicated follower of Dick and Jane’s journey or just joining in, this edition promises a refreshed perspective on securing your retirement amidst the ever-evolving financial landscape. What’s New in “Save Your Retirement Edition 4? 1. Streamlined…

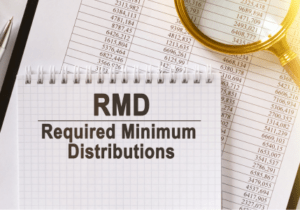

Read More →Retirement Accounts & RMDs

RMDs are crucial for retirement account owners age 73 and older Some qualified retirement account owners are surprised that the IRS requires them to take a certain amount from their accounts each year. Including required minimum distributions in your financial plan can help you avoid higher taxes and potential IRS penalties. If you own a qualified retirement…

Read More →Ready to Take The Next Step?

For more information about any of the products and services we offer, schedule a meeting today or register to attend a seminar.